- #Folio investing interactive brokers pro

- #Folio investing interactive brokers software

- #Folio investing interactive brokers plus

- #Folio investing interactive brokers free

Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. The monthly returns are then compounded to arrive at the annual return. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return.

#Folio investing interactive brokers plus

Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. These returns cover a period from Januthrough July 3, 2023. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.26% per year. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. and Morningstar, Inc.Ĭopyright 2023 Zacks Investment Research | 10 S Riverside Plaza Suite #1600 | Chicago, IL 60606Īt the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. Forbes Media, LLC Investor's Business Daily, Inc.

Each of the company logos represented herein are trademarks of Microsoft Corporation Dow Jones & Company Nasdaq, Inc. This page has not been authorized, sponsored, or otherwise approved or endorsed by the companies represented herein. The stocks in this report could perform even better. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance.

They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases. The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. Breakout Biotech Stocks with Triple-Digit Profit Potential You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. Shares of Interactive Brokers have rallied 22.3% over the past six months, outperforming the industry’s growth of 21%.Ĭurrently, Interactive Brokers carries a Zacks Rank #2 (Buy).

#Folio investing interactive brokers software

Also, the company’s main focus on developing proprietary software to automate broker-dealer functions is expected to continue resulting in rise in its market share. So, in order to maintain/boost its market share and benefit from extreme volatility in the markets, Interactive Brokers’ latest acquisition is a step in the right direction.

#Folio investing interactive brokers free

With Charles Schwab’s ( SCHW Quick Quote SCHW - Free Report) acquisition of TD Ameritrade and Morgan Stanley’s ( MS Quick Quote MS - Free Report) buyout of E*Trade Financial, the industry is undergoing major upheavals. Our TakeĬonsolidation has been going on in the online brokerage space for quite some time now.

#Folio investing interactive brokers pro

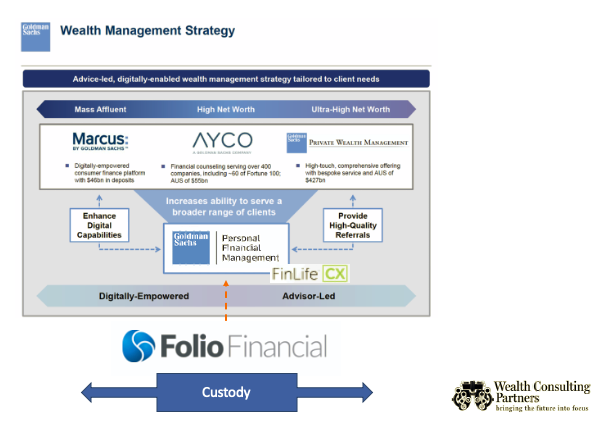

Further, the clients will have the option to select IBKR Lite or IBKR Pro plan service plans per their needs. Interactive Brokers CEO Milan Galik said, “With the transition to our firm, Folio Investments’ former clients now will be able to invest in stocks, options, futures, currencies, bonds and funds worldwide from a single, integrated account.”įolio Investments clients till now only had access to the U.S.-listed stocks and “commission-free trading at scheduled times.” But following the completion of the deal, the clients will be able to trade in a wide range of securities including stocks, ETFs and other asset classes for unlimited commission-free trading and/or at low commissions. In fact, the same witnessed a jump of 61% from the prior-year level. At the end of November, Interactive Brokers had 1.04 million client accounts, up 52% year over year.Īdditionally, approximately $3 billion in client equity will get added to Interactive Brokers’ client equity balance, which was $268.7 billion at November end. The transaction will lead to the addition of nearly 70,000 current Folio Investments’ “self-directed” clients to Interactive Brokers. The clearing and custodian services division of Folio Investments is not included in the current deal and remain part of Goldman’s operations. The terms of the deal, expected to close in January, were not revealed.įolio Investments is a subsidiary of Folio Financial, Inc., which was acquired by Goldman Sachs ( GS Quick Quote GS - Free Report) in September 2020. With an aim to further strengthen its position in online brokerage space, Interactive Brokers Group ( IBKR Quick Quote IBKR - Free Report) has inked a deal to acquire Folio Investments Inc.’s “self-directed” retail brokerage division.

0 kommentar(er)

0 kommentar(er)